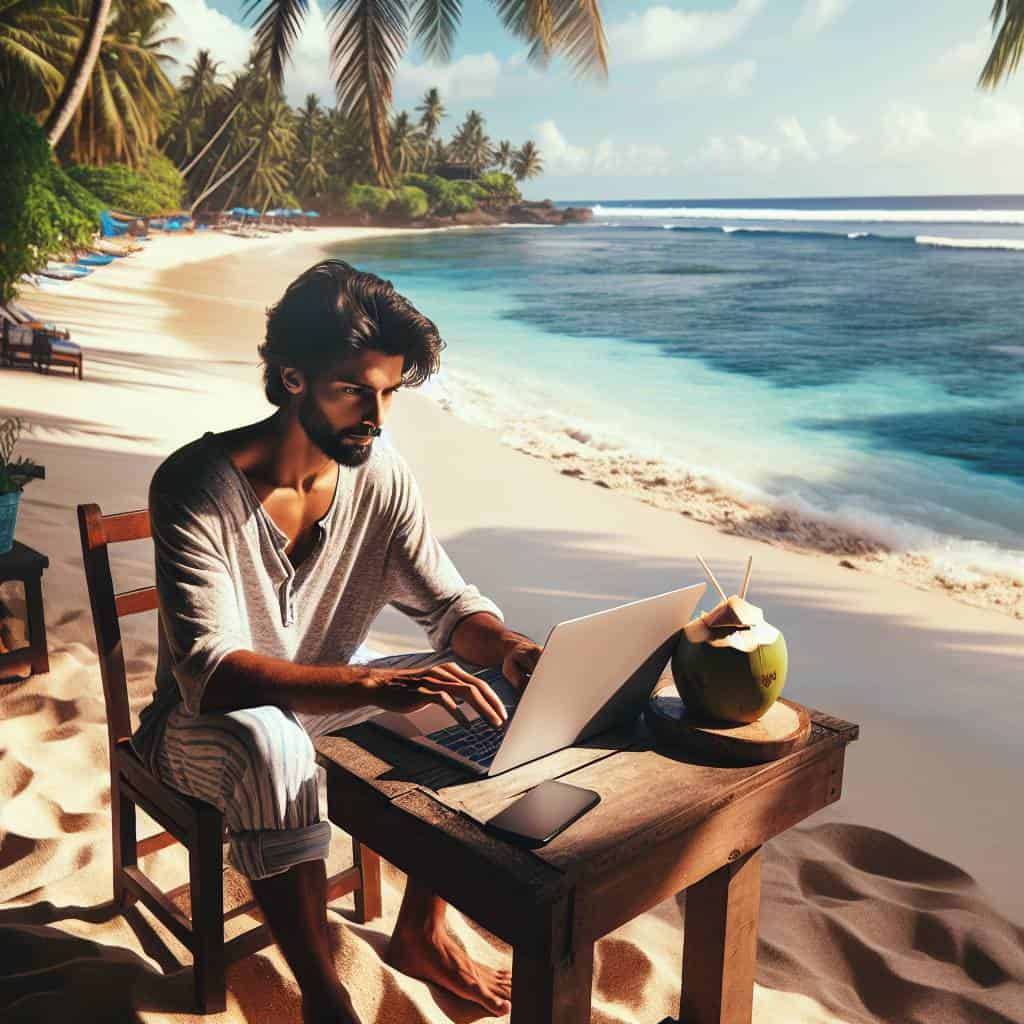

So, there I was, sitting on a beach in Bali, laptop in one hand, a coconut in the other, feeling like the poster child for digital nomad success. Until a notification pinged—a not-so-gentle reminder from my bank that my account was teetering on the edge of oblivion. Turns out, the sun-kissed lifestyle isn’t as forgiving when you’re trying to juggle five currencies and a tax system that seems to have been designed by a particularly vindictive accountant. Managing your finances while globe-trotting sounds glamorous until you’re the one calculating exchange rates in a dimly lit hostel, wondering if eating that local delicacy last night was worth the overdraft fee.

But here’s the deal. I’ve waded through the chaos, so you don’t have to. This article isn’t going to offer you the glossy, brochure-version of financial planning that conveniently ignores the ugly bits. No, we’re diving into the gritty reality of international banking, tax mazes, and budgeting nightmares. Consider this your rough-and-tumble guide to keeping your finances afloat while living the dream—or at least pretending you are. Stick around, and I’ll show you how to turn this circus act into a somewhat sustainable routine, without setting your finances on fire.

Table of Contents

How I Dodged International Banking Nightmares (Mostly)

Let’s get something straight: managing your finances while living the digital nomad life isn’t just about Instagram-worthy beachside desks. It’s about navigating the labyrinth of international banking without losing your sanity or your shirt. I’ve had my share of close calls—like the time a bank in Bangkok decided to freeze my account because they were convinced I was part of some international money-laundering scheme. Spoiler: I wasn’t. But over time, I’ve learned a few tricks to keep the banking nightmares mostly at bay.

First, diversify like you’re in a casino, and the house is always scheming to take your chips. I keep accounts in multiple currencies across different countries. Why? Because relying on a single bank is like trusting a parachute stitched together with chewing gum and hope. If one account gets frozen, I still have access to funds elsewhere. It’s not paranoia; it’s survival. And let’s talk about fees—those sneaky little vampires that suck your money dry when you’re not looking. Find a bank that doesn’t treat international transactions like they’re swapping gold bars. It’s your money, not a ransom payment.

Then there’s the art of budgeting on the fly. Forget the spreadsheets and the financial advisors—those are luxuries for stationary folks. Instead, I use a simple rule: if I can’t explain a purchase to a skeptical customs officer, I don’t need it. This minimalist approach keeps me focused on the essentials while ensuring I’m not tempted by every shiny gadget or local trinket. And taxes? Let’s just say it’s a dance with a tax professional who understands the nomadic lifestyle. They keep me on the right side of the law while I keep chasing the horizon. It’s a partnership built on mutual respect and the shared understanding that no one wants to end up explaining their international income to a confused auditor.

The Balancing Act: Finances on the Move

In the world of digital nomads, budgeting isn’t just a spreadsheet exercise—it’s a survival skill. When your office is a hammock, and your paycheck is a leap of faith, mastering the art of international banking becomes your lifeline.

The Art of Balancing on Financial Tightropes

Looking back, managing finances as a digital nomad has been less of a structured plan and more of a high-stakes game of whack-a-mole. International banking issues pop up like weeds in an untended garden, and just when you think you’ve got a handle on them, another one rears its ugly head. But maybe that’s the beauty of it. The constant challenge, the never-ending puzzle of paying taxes in one country while budgeting for the next, keeps me sharp. Keeps me grounded in the reality that this lifestyle, as glamorous as it might seem on a screen, is built on the back of gritty, relentless effort.

It’s funny how the quest for freedom—geographical or otherwise—tethers you to the minutiae of financial planning. Yet, there’s a certain satisfaction in knowing I’ve navigated this chaotic maze without losing my shirt. My journey isn’t about chasing a dream of endless beaches and open skies; it’s about finding a rhythm amidst the chaos, a dance with the unpredictable nature of international living. And as long as I can keep my balance on this tightrope, I’m ready for whatever comes next.